Most of us keep our surplus cash lying in our savings bank account. It is safe and convenient, if we need to use the money on a frequent basis. However, we should, from time to time, take a look at our savings bank statement and ask ourselves, how much balance we should have in our savings bank account? We should always keep our funds for emergency purposes in our savings bank account. But very often we have much more lying in our savings bank, either because we are waiting for an upcoming expense or we do not know what to do with the money.

Investing your surplus cash in liquid funds is a much smarter option than having it lie idle in your savings bank account. Liquid funds are money market mutual funds and invest primarily in money market instruments like treasury bills, certificate of deposits and commercial papers and term deposits, with the objective of providing investors an opportunity to earn returns, without compromising on the liquidity of the investment. Liquid funds can give pre-tax returns of 9 – 10%, compared to the 4% interest paid by savings bank. Most liquid funds do not have any exit load. Even those funds that have exit load charge a nominal load for funds redeemed within a week or a month. Withdrawals from liquid funds are processed within 24 hours on business days.

Key Benefits of Liquid Funds:

- High liquidity: Most liquid funds do not have any exit load. Even those funds that have exit load charge a nominal load for funds redeemed within a week or a month. Withdrawals from liquid funds are processed within 24 hours on business days.

- Higher returns than savings bank: Liquid funds give higher returns than savings bank. Savings bank interest rate is around 4% (some banks offer slightly higher rates, subject to a minimum balance), calculated on daily balance and compounded monthly. Top ranked liquid funds have given over 8% pre tax returns in the last one year.

- Low volatility: Liquid funds are less volatile than longer term debt funds, since the underlying securities in their investment portfolio have short durations. Fixed income securities with short durations or maturities have lower interest rate risk, since the probability of the interest rates changing before the maturity of the securities is lower.

- Tax efficiency: If liquid funds are redeemed within a year, then capital gains are taxed at the applicable income tax slab rate of the investor. However, dividends from liquid funds are tax free in the hands of the investors, but the fund houses have to pay a dividend distribution tax of 28.325% before distributing dividends to the investors. Therefore, investors in the highest tax bracket can get tax benefits by opting dividend reinvestment option.

Savings Bank Interest

Most of us do not pay much attention to savings bank interest because the interest rate is too low and it does not show on our monthly bank statement. However, if your savings account average balance is high, then you may be losing a lot by keeping your money in savings bank account and not investing it in liquid funds, as we will see in this blog. But first let us understand how much interest your savings bank pays you.

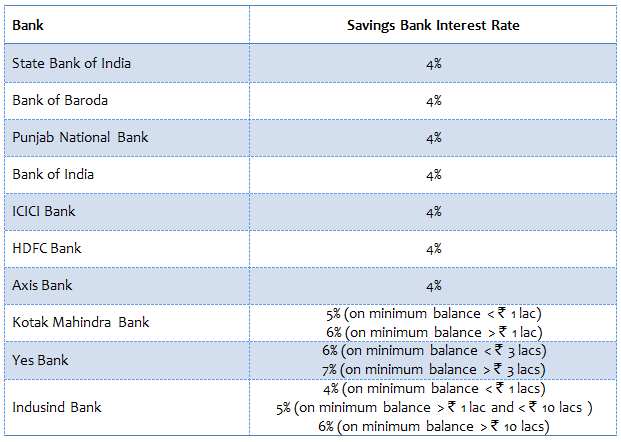

The vast majority of banks pay an annual interest rate of 4% in savings accounts. Some private sector banks, e.g. Kotak Mahindra Bank, Yes Bank etc pay a higher interest rate subject to certain conditions. The table below shows the current savings bank interest rate some of the largest private and public sector banks.

As per RBI guidelines, the savings bank interest has to be calculated on daily basis on the day’s closing balance. Let us understand this with the help of an interest. Let us assume you have र 100,000 balance in your savings bank account today and your savings bank interest rate is 4% per annum. The interest for the day will be calculated as below:

- Today’s Interest = (100,000 X 4%) / 365 = 10.96

- If you withdraw

र10,000 tomorrow, then your account balance will beर90,000. The interest for tomorrow will be:- - Tomorrow’s Interest = (90,000 X 4%) / 365 = 9.86

- If you deposit

र20,000 day after tomorrow then your account balance will beर110,000. The interest for day after tomorrow will be:- - Day after tomorrow’s Interest = (110,000 X 4%) / 365 = 12.05Therefore, the total earned by you over these three days will be

र10.96 + 9.86 + 12.05 = 32.86/-.

You should also understand the interest is not credited to your savings bank account every day. Actually, it is not even credited to your bank account at the end of the month. As per RBI guidelines, banks need to credit the savings bank interest on a quarterly basis. Some of us have the misconception that savings bank interest is compounded daily or monthly. It is important to understand that compounding cannot take place unless the interest is credited to your account. Since the interest is credited to your account on a quarterly basis, the compounding takes place quarterly.

Liquid Fund Returns

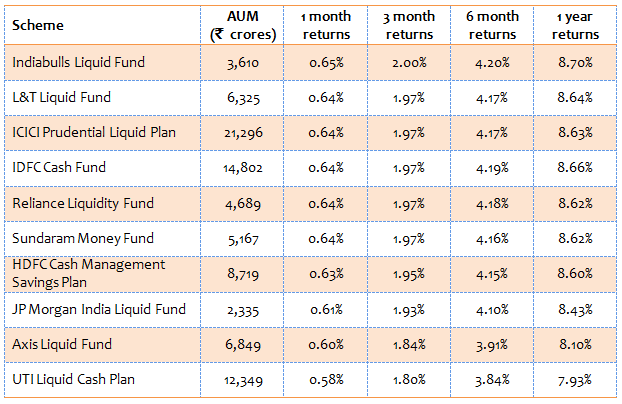

In selecting liquid funds, one must be careful and select top quality funds only. While AUM is not such an important consideration for equity funds, it assumes importance when selecting liquid funds. Other considerations as per CRISIL are returns, volatility, downside risk probability, asset quality, concentration risk and liquidity risk. In today’s blog we selected 10 top performing liquid funds based on CRISIL’s ranking. Investors should note that unlike your savings bank interest rate, liquid fund returns are not assured. However, liquid funds offer high degree of capital safety and liquidity. Also, since liquid fund investments are done over short durations, one can get a good sense of the expected returns from recent trends, after allowing for a few basis points of downside or upside in yields. The table below shows the top liquid funds (returns are on a trailing basis, as on Sep 23, 2015). You should note that yields have been on a declining trend in India over the past year and therefore you should give more importance to the 1 month and 3 months returns rather than the 1 year returns.

Difference in returns between liquid funds and savings bank

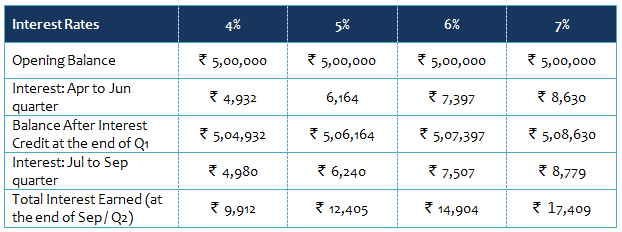

Let us see with the help of an example. Let us assume, you always have र 500,000 in your savings bank account. Let us see how much interest you will earn in the period April 1, 2015 to September 30, 2015.

Let us now see, how much return you would have got if you invested र 500,000 in one of the top performing liquid funds, 6 months back. Assuming you got a return of 4.15% (you can see from the table of top performing liquid funds that you could have got up to 4.2% returns) your total returns would be र 20,750. This is more than double of what you would get from most savings bank accounts. Even if you got 7% interest rate in your savings bank account, the liquid fund returns are still much higher. In fact, all the liquid funds in our selection would have given higher returns than the highest interest rate paid by savings bank.

Choosing a liquid Mutual fund

However, investors should select liquid funds from reputed AMCs and funds that have substantial assets under management (AUM). Liquid funds come with different distribution options e.g. growth plan, daily dividend plan, monthly plan. You should consider your tax situation, when you decide which plan to invest in. As discussed earlier, short term capital gains from liquid funds are taxed at the applicable income tax slab rate of the investor. Since in dividend options, ideally all profits should be paid out as dividends therefore there should be no capital gains. Dividends are tax free in the hands of the investors, but the AMC withholds dividend distribution tax @ of 28.325% before distributing dividends to the investors. If you fall in the 10% or 20% tax bracket, you should invest in the growth plan, since your tax rate is lower than the dividend distribution tax rate. On the other hand, if you are in the highest tax bracket (30%), then dividend payout or dividend re-investment will be smarter option from a tax perspective. If you need cash flows during your investment period, then it makes sense to go for dividend payout option. However, if you need the cash flow during the investment period then you should opt for dividend reinvestment. Let us explain why, in dividend or dividend reinvestment option the profits are paid out in form of dividends. The difference between dividend and dividend reinvestment option is that, while in the dividend option the dividend is credited to the bank account of the investor, in the dividend reinvestment option, the dividends are reinvested to buy units of the scheme at the ex-dividend NAV. The effect of taxes in dividend payout and dividend reinvestment option is same. However, in a dividend re-investment option since your funds remain invested, you can earn higher returns compared to dividend pay-out option.

Is short term capital gains tax possible in dividend or dividend reinvestment options? Practically speaking, the answer is yes. If you redeem your units before the dividend payout date, the NAV of your liquid fund units is very likely to be higher than your purchase price and hence will attract short term capital gains. How can you minimize short term capital gains in dividend options? You can minimize your short term capital gains in dividend options, by selecting an option which pays dividend more frequently, e.g. monthly dividend pay-out or monthly dividend reinvestment.

Conclusion

Liquid funds are very good investment options for parking your short term funds. Though liquid funds do not provide the convenience of making deposits or withdrawals on weekends and after business hours (through ATMs), something which banks provide, if retail investors can plan their cash flow needs a few days in advance, they can earn higher returns by investing their surplus cash in liquid funds than having it lie idle in their savings bank account.

(First published in Advisorkhoj.com)

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.