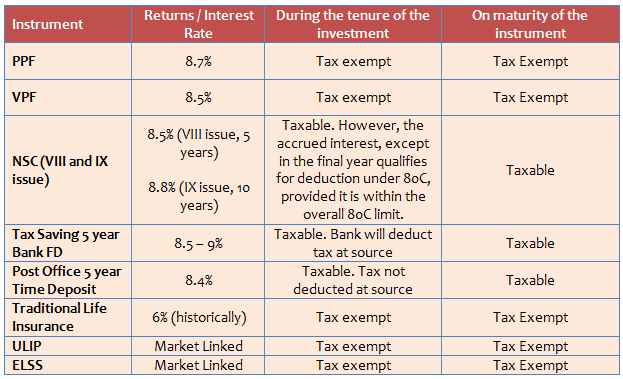

Tax Planning should always begin at the beginning of the financial year and not towards the end. Remember, the longer you wait for start your investment, the more you will lose out on returns. Section 80C of Income Tax Act allows tax payers to claim deductions from their taxable income by investing in certain instruments. Equity Linked Saving Schemes (ELSS) is one of the most popular investments allowed under Section 80C, since the investors can avail double benefits of capital appreciation and tax savings. An ELSS is a diversified equity scheme with a lock in period of three years from the date of the investment. If you invest in an ELSS through a systematic investment plan (SIP), each SIP investment will be locked in for 3 years from their respective investment dates. There are both growth and dividend options for ELSS. For tax purposes, both long term capital gains and dividends from ELSS are tax free. Over a long time horizon, equity investments give superior returns compared to fixed income investment options like PPF, NSC and Fixed Deposits.

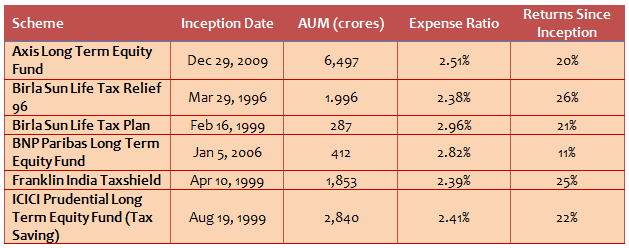

In this article, we will review the top performing ELSS Schemes of Mutual Funds as per CRISIL ranking (returns and scheme details are as of November 10, 2015).

- Axis Long Term Equity Fund: Axis Long Term Equity Fund has provided the highest 3 year annualized return at nearly 30%. It has consistently outperformed all its peers in terms of annual returns over the 3 years period. Volatility of returns is low relative to its peers, as per CRISIL ranking. Its portfolio is sufficiently diversified, with a large cap bias, with HDFC bank, Kotak Mahindra Bank, TCS, HDFC and Sun Pharma accounting for nearly 32% of its portfolio. However, the overall portfolio is sufficiently diversified with the top 10 stocks accounting to just over 51% of the portfolio. The fund is well diversified across sectors with the top 3, Banking / Finance, Auto and Pharma accounting to just over 53% of the portfolio.

- Birla Sun Life Tax Relief 96: The 3 year annualized return of Birla Sun Life Tax Relief 96 is nearly 25%. While the volatility of returns is in line with its peer set as per CRISIL ranking, it has provided high annualized returns relative most peers, over the last 1 year. In terms of portfolio composition, the fund has a large cap bias with Honeywell Automation, Sundaram Clayton, Bayer Cropscience, ICRA and Kotak Mahindra Bank accounting for nearly 26%, the fund is well diversified with top 10 stock accounting for only 43% of its overall portfolio. In terms of sectoral allocation Banking / Finance, Automobiles and Services account for about 52% of portfolio.

- Birla Sun Life Tax Plan: Birla Sun Life Tax Plan’s 3 year and 1 year annualized returns stand at nearly 24 and 15% respectively, outperforming ELSS as a category over each of these periods. Volatility of returns is in line with its peers, as per CRISIL ranking. In terms of portfolio composition, the fund has a large cap bias with Honeywell Automation, Sundaram Clayton, Bayer Cropscience, ICRA and Kotak Mahindra Bank accounting for nearly 26%, the fund is well diversified with top 10 stock accounting for only 42% of its overall portfolio. In terms of industry concentration, Banking / Finance, Automobiles and Services account for 50% of portfolio.

- BNP Paribas Long Term Equity Fund: The annualized 3 year and 1 year returns of BNP Paribas Long Term Equity Fund are nearly 24% and 11% respectively. The volatility of returns is average relative to its peer group. The portfolio is fairly well diversified across large cap companies, with the top 5 holdings HDFC Bank, Idea Cellular, Bharti Airtel, Indusind Bank and Kotak Mahindra Bank accounting for nearly 32% of the portfolio value, while top 10 holdings account for about 49% of the portfolio. In terms of industry exposure the fund is well diversified with Banking / Finance, Telecom and IT accounting for nearly 53% of the portfolio.

- Franklin India Taxshield: The annualized 3 year and 1 year returns of Franklin India Taxshield Fund are nearly 23% and 11% respectively. Volatility of returns is low relative to its peers, as per CRISIL ranking. The portfolio has a large cap bias, with the top 5 holdings, HDFC Bank, Infosys, Indusind Bank, ICICI Bank and Bharti Airtel, accounting for 24% of the portfolio. The top 10 holdings account for about 37%. In terms of industry exposure, Banking / Finance, IT and Pharma account for 49% of the portfolio.

- ICICI Prudential Long Term Equity Fund (Tax Saving): The annualized 3 year returns of this ELSS wealth creator tax saver ICICI Prudential Long Term Equity Fund (Tax Saving fund) is 21%. Volatility of returns is in line with the ELSS category. The fund has a large cap bias. The investment style is growth focused. From a sector perspective, the portfolio has a bias for cyclical sectors like Banking and Finance, Automobiles and Auto Ancillaries, Mining and Minerals, Capital Goods etc, but it also has substantial allocations to sectors like IT and Pharmaceuticals. This portfolio construction enables the fund manager to get good returns across different market conditions. In terms of company concentration, the portfolio is very well diversified with its top 5 holdings, HCL Technologies, HDFC Bank, Cipla, Thomas Cook, and Power Grid accounting for only 34% of the total portfolio value.

The table below shows different statistics of these ELSS funds.

Liquidity

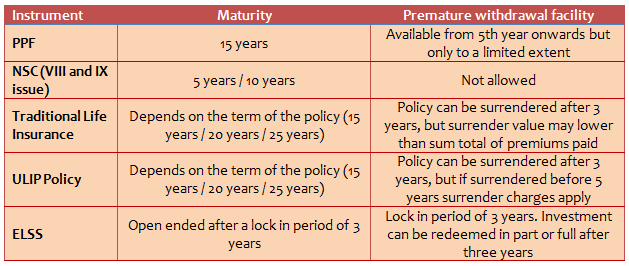

Liquidity is an important consideration for tax planning investment. There is no general financial planning guidance on liquidity. It depends on the financial situation of the investor like, income, fixed expenditure, savings pattern, existing assets, liquidity of those assets etc. When you make an investment, you should make sure that you are comfortable with the liquidity of the investment that you are making. The table below shows the liquidity related considerations for these 80C investment options.

Conclusion

Equity Linked Saving Schemes (ELSS) or tax saver funds of Mutual Funds should form an essential part of investors’ mutual fund portfolios. Over a long investment horizon, investors can not only save substantial amount in income taxes, but also create wealth to meet their long term financial goals.

(First published in Advisorkhoj.com)

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.